Hacking Alpha

Founder's Special Expires in:

00

DAYS

00

HOURS

00

MINS

00

SECS

Hacking Alpha

A Live Market Research Publication from OptionPundit

Documenting how a $25,000 portfolio is structured, managed, and defended in real time in 2026 and beyond.

It is a research journal for traders who want to understand process, not chase outcomes.

2026 Is Not the Year to “Try Harder”

It’s the year to stop improvising.

Most traders don’t lose money because they’re unintelligent.

They lose because their decisions are context-free.

They react.

They chase.

They manage trades emotionally instead of structurally.

And in a market dominated by institutions, algorithms, and volatility compression…

Reaction is extinction.

From the Research Desk of

Manoj Kumar

Founder, OptionPundit (est. 2006)

Singapore

For nearly two decades, my work has revolved around a single question:

How does professional capital actually behave—before, during, and after opportunity emerges?

Not what’s taught in textbooks.

Not what’s shouted on social media.

But what is documented when real money is deployed under constraints.

Over 17 years, I’ve built and refined systematic trading blueprints that prioritize:

-

Risk containment before return

-

Structure before opinion

-

Process before outcome

These frameworks—internally known as PP33™, 5D™, M30™, CamelCurl™, L2R™, Mt Fuji™, Flying Condor™, 222™, and Tiara™—were never designed as “strategies for sale.”

They were built as operating systems.

And until now, they have lived mostly behind closed doors—inside paid programs, private coaching, and internal research notes.

Why Hacking Alpha?

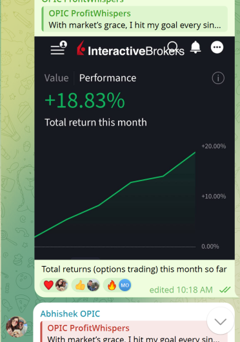

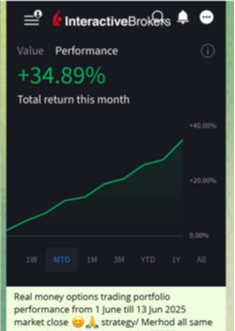

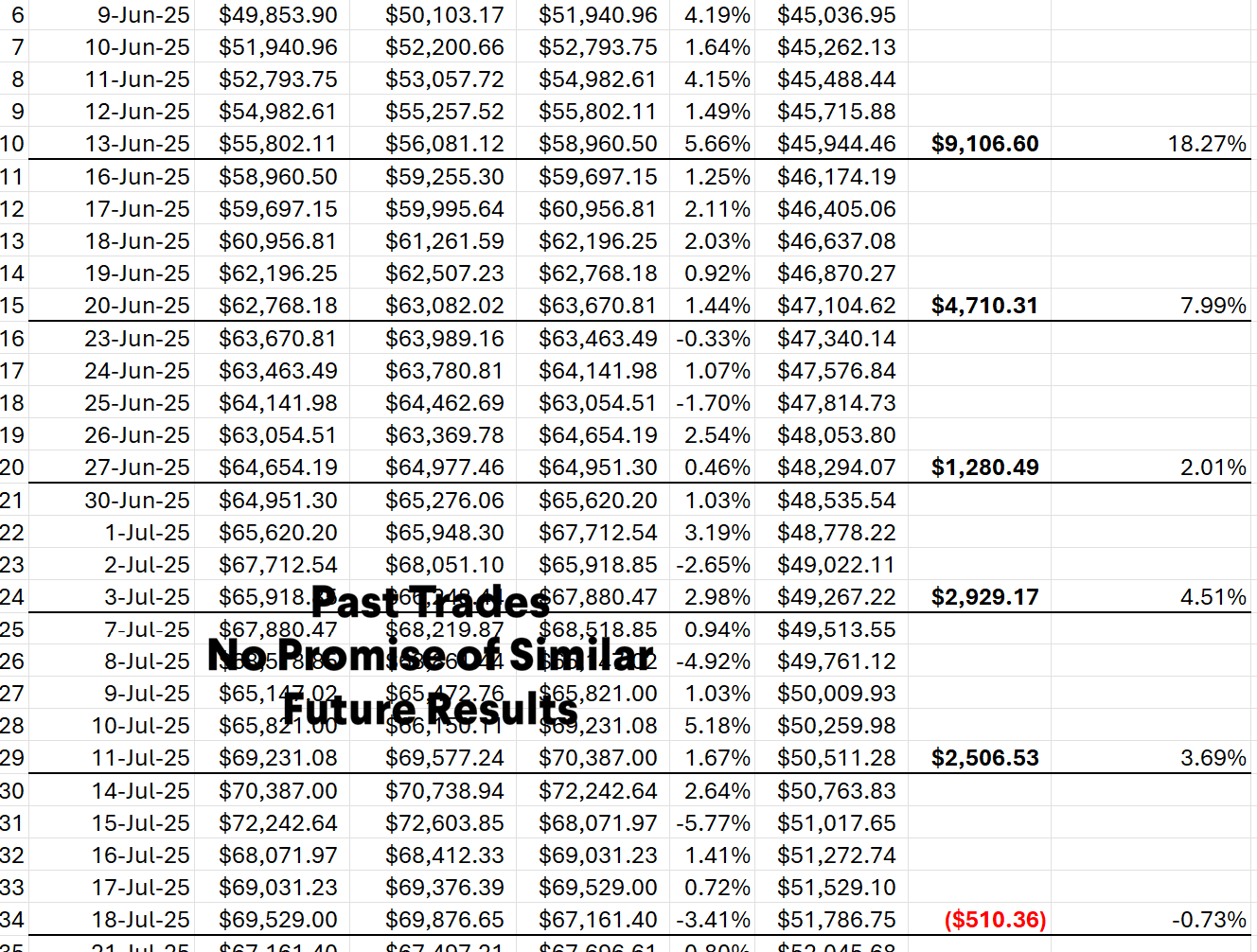

In June 2025, I ran a structured execution challenge within a private trading community.

The focus was not on maximising returns, but on executing predefined frameworks with discipline, managing risk actively, and documenting every material decision.

The screenshots and records below reflect the historical performance of that period under the market conditions that existed at the time.

These outcomes are not indicative of future results and should not be interpreted as expectations or projections.

What is relevant — and repeatable — is the process:

• How exposure was sized

• How risk was adjusted as conditions changed

• How decisions were recorded and reviewed

• How discipline was maintained during both gains and drawdowns

HackingAlpha.report is built to document that decision-making process as a live research exercise — not to reproduce past outcomes.

Historical Report

*Historical performance shown for documentation purposes only. Past results are not indicative of future outcomes.

Tracking Alpha Report Launched

In 2026, I am formalizing something I’ve done privately for years:

A live, continuously documented research portfolio.

Not a course.

Not a signal service.

Not a promise.

A bona fide research publication centered on a $25,000 reference portfolio, designed to answer one question:

What does disciplined, institutional-style execution actually look like in real time—across different market regimes?

Every action in this portfolio is treated as:

-

A case study

-

A research artifact

-

A decision log

Nothing more. Nothing less.

So, What is Hacking Alpha?

HackingAlpha.report is:

✔ A market research journal

✔ A live portfolio observation project

✔ A documentation of decision-making under uncertainty

✔ A running archive of trade structures, adjustments, and outcomes

It is not:

✘ Investment advice

✘ A solicitation

✘ A personalized service

✘ A guarantee of results

The $25,000 Real-Money Model Portfolio

At the core of Hacking Alpha is a single reference portfolio, funded and managed by me.

This portfolio exists for one reason only:

To create a clean, auditable, time-stamped trail of how systematic decisions are made.

You will observe:

-

Position structures

-

Entry rationale (framework-based, not predictive)

-

Risk parameters

-

Adjustments and repairs

-

Closures and post-mortems

No hindsight edits.

No cherry-picking.

No “theory only.”

What Subscribers Actually Receive?

1. Portfolio Transparency Archive

A continuously updated ledger of:

-

Open positions

-

Closed positions

-

Structural changes

-

Risk posture shifts

This is documentation, not instruction.

2. Research Alerts

When a portfolio action is logged, subscribers receive a research alert. These alerts are framed as:

“Action taken in the model portfolio under X conditions.”

3. The Repair & Risk Log

Most publications avoid discomfort.

Hacking Alpha doesn’t.

You will see:

-

When positions are stressed

-

When assumptions fail

-

When capital is defended instead of deployed

Because risk management is the alpha most people never study.

4. Monthly Research Briefing (Live)

Once per month, I host a live session to:

-

Review portfolio evolution

-

Discuss regime context

-

Explain why certain structures were favored or avoided

This is research commentary, not coaching.

5. Full Historical Access

Every new subscriber receives access to the entire yearly archive—not just what’s happening now.

Markets repeat.

Context rhymes.

Archives matter.

Why Limited “Founder’s 50” Seats?

Before this publication is released publicly, I am opening 50 founder seats.

Not because I need validation.

But because early-stage research environments function best with:

-

Experienced readers

-

Low noise

-

High signal

These 50 members form the initial research cohort.

Once filled, this pricing is permanently closed.

Founder Privileges

-

Permanent Founder Pricing

Public price (post-launch): $199/month

Founder price: $59/month, locked for life -

Priority Access to Live Briefings

Founders receive first access to live research calls. -

Founder Archive Tag

Early members retain archive continuity as the publication evolves.

This is not a “discount.”

It’s a structural advantage.

YOUR SUBSCRIPTION INCLUDES

✔ Monthly LIVE webinar

Market updates, open discussions, and a walkthrough of the TA model portfolio

(Educational session – not personalised advice)

✔ Around 4-6 ideas per month (on average)

Shared for learning and discussion purposes, with clear structure and rationale

✔ Clear technical breakdowns

Including chart context, option pricing references, and risk considerations

(No trade is guaranteed)

✔ One exclusive starter video

Covers portfolio allocation basics and risk awareness for options traders

✔ Manoj Kumar's Power watchlist

A curated list of stocks and options setups under active observation

✔ 24/7 access to historical TA trade records

For transparency, study, and self-review

✔ One-way trade action notification channel

To stay informed when updates are shared

(Execution remains your own decision)

✔ Community discussion group*

For educational discussions around TA trades and market behavior

*Community guidelines apply

*Before subscribing, users are required to complete a short declaration to confirm suitability and understanding of risks.

Click “Subscribe Now” to proceed.

Who This Is For?

✔ Experienced traders who already understand options mechanics

✔ Professionals who value process over excitement

✔ Investors who want to observe institutional logic, not outsource decisions

Who Should Not Join?

✘ Beginners

✘ Anyone looking for signals or certainty

✘ Anyone uncomfortable with drawdowns, ambiguity, or patience

If you need persuasion, this is not for you.

Capacity & Closure

Founder access is capped at 50 seats or End of Founder's promotion, whichever is later.

When filled:

-

Pricing increases

-

Founder privileges end

-

Public access begins later at full price

No exceptions.

Final Note (Read Carefully)

HackingAlpha.report is a bona fide financial research publication.

It is designed to document market behavior and portfolio decision-making for educational and informational purposes only.

I am not acting as your adviser.

I am not managing your money.

I am not recommending actions.

I am publishing research.

Happy Trading.

Frequently Asked Questions

Is this a signal service?

Can I copy or mirror the trades shown in the reference portfolio?

Are you managing my money?

Are you licensed by the Monetary Authority of Singapore (MAS)?

Is this investment advice?

What exactly is the $25,000 reference portfolio?

Will you show profits and losses?

What level of experience is required?

What markets or instruments do you cover?

How often are updates published?

Is there a minimum or maximum return I should expect?

Can I ask questions or request trades?

Can I cancel anytime?

Why are spots limited?

Legal Disclaimer & Important Notices

1. Nature of the Publication

HackingAlpha.report is a general market research and educational publication.

All content provided through this publication—including commentary, portfolio documentation, charts, observations, research notes, alerts, briefings, and archival materials—is published solely for informational and educational purposes.

Nothing contained in HackingAlpha.report constitutes:

-

Investment advice

-

Financial advice

-

Trading advice

-

A recommendation, solicitation, or offer to buy or sell any securities, derivatives, or financial instruments

This publication is not tailored to any individual’s financial circumstances, objectives, or risk tolerance.

2. No Licensed Financial Advice

Manoj Kumar is not acting as a licensed financial adviser under the Financial Advisers Act of Singapore.

HackingAlpha.report does not provide:

-

Personalised investment advice

-

Advisory services

-

Discretionary portfolio management

-

Execution or trade placement services

Subscribers are solely responsible for their own investment decisions and outcomes.

3. Reference Portfolio & Research Context

Any portfolio, position, transaction, adjustment, or outcome referenced in this publication relates to a reference portfolio maintained for research and educational documentation purposes only.

The reference portfolio:

-

Is not intended to represent suitable investments for any subscriber

-

Is not a recommendation to replicate or mirror any position

-

Is used solely to study and document decision-making processes under varying market conditions

Subscribers should not interpret any portfolio activity as an instruction or suggestion to take similar actions.

4. No Guarantee of Results & Risk Disclosure

Past performance, whether actual or simulated, does not guarantee future results.

Trading and investing in financial markets—including equities, options, futures, ETFs, CFDs, and other instruments—involves substantial risk, including the risk of loss of capital.

Market conditions can change rapidly and unpredictably.

Losses may exceed initial expectations.

No representation or warranty is made that any research, observation, or methodology discussed will result in profits or avoid losses.

5. Accuracy, Completeness & Forward-Looking Statements

Information contained in this publication is derived from sources believed to be reliable; however, no warranty is given as to accuracy, completeness, timeliness, or reliability.

This publication may contain forward-looking statements, including opinions, assumptions, expectations, or observations regarding future market behaviour.

Such statements are inherently uncertain and subject to change.

Actual outcomes may differ materially from any forward-looking statements expressed or implied.

6. Limitation of Liability

To the fullest extent permitted by law:

-

Manoj Kumar

-

HackingAlpha.report

-

OptionPundit and its affiliates

shall not be liable for any direct, indirect, incidental, or consequential loss or damage arising from:

-

Use of, or reliance on, information contained in this publication

-

Errors, omissions, delays, or interruptions in content delivery

-

Market losses or trading decisions made by subscribers

Subscribers accept full responsibility for their own investment decisions.

7. Independent Decision-Making Responsibility

Subscribers acknowledge that:

-

They are acting independently

-

They are responsible for conducting their own due diligence

-

They should seek advice from licensed professionals where appropriate

Nothing in this publication should replace professional financial, legal, or tax advice.

8. Acceptance of Terms

By accessing or subscribing to HackingAlpha.report, you acknowledge that you have read, understood, and agreed to this disclaimer and its terms.